Policy Briefing Paper Financial Inclusion

About the paper

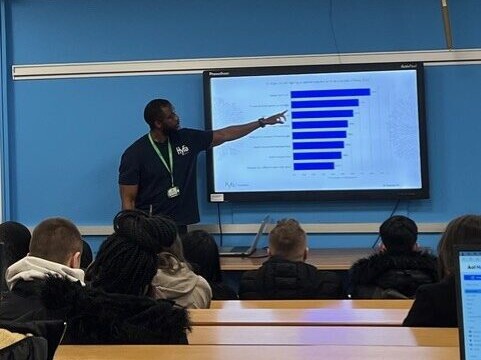

Hyfa Foundation is the proud lead sponsor for a policy briefing paper that explores the need for regional strategies to address financial exclusion among young people, grounded in data and the lived experiences of the youth themselves.

New research underlying the policy briefing paper has been overseen by Calvin Cowell, Founding Trustee at Hyfa Foundation, who has previously produced ground-breaking research around inequality in the UK financial system.

Sign up here to receive the policy briefing paper in your inbox:

This policy briefing paper outlines a set of evidence-based recommendations, and is presented as an open letter to key government departments that can be the engine of change. Importantly, the paper reframes financial inclusion not as a technocratic fix, but as a core part of a broader youth empowerment agenda.

The policy briefing provides actionable insights for policymakers, educators, financial institutions, and youth organisations alike. The message is clear: if we are serious about empowering the next generation, we must start by ensuring every young person (regardless of background) has a fair chance to build a financially secure future.

About the author

Calvin Cowell is an experienced and award-winning financial services leader who has worked extensively across sectors in London and the South East.

He is one of the country’s leading authorities on financial inclusion, having recently competed a PhD in Economics where he delivered pioneering research into the causes and long-term solutions to financial exclusion.

Calvin has over 15 successful years working in a global financial services company and has gained a Diploma and an MSc in Banking; he has also achieved Chartered Banker status (MCBI) at the prestigious Chartered Banker Institute.

Born in Jamaica, Calvin has British heritage that predates the Empire Windrush, he is now father to 4 children including 2 daughters and 2 sons.

Throughout his career in financial services, working directly with the public Calvin often saw first-hand the positive and negative impact that financial literacy has on people and businesses. This was the basis for starting Goldstar Consultancy his financial wellbeing company.

About financial inclusion

In the critical transition years from adolescence to adulthood, access to financial tools and knowledge is more than a convenience – it’s a foundation for independence, opportunity, and agency.

For young people aged 16–25 in deprived areas, financial inclusion can be the difference between being empowered participants in society and being left behind.

Yet research reveals a persistent and damaging gap: too many young people in disadvantaged communities remain financially excluded, underbanked, and underinformed.

Calvin’s research highlights how financial exclusion is not simply about lacking a bank account, but rather being locked out of the systems that enable long-term decision-making: saving, building credit, accessing housing, starting a business, or even affording further education.

For many in deprived areas, the financial system feels alien or hostile. This is not just a logistical problem or minor inconvenience, it’s a profound issue of social justice and youth empowerment.

At a time when young people face rising costs of living, insecure work, and diminished trust in institutions, financial inclusion offers a rare intersection between immediate needs and long-term resilience.

It’s not about teaching topics like budgeting in isolation, it’s about enabling choice, voice, and power.

Frequently asked questions

A policy briefing paper is a short, focused document that provides decision-makers (for example, government officials, MPs, or senior civil servants) with clear, concise, and evidence-based information about a specific policy issue. Its purpose is to inform, influence, or support policy decisions.

Financial inclusion refers to the process of ensuring that individuals and businesses, regardless of their income level or location, have access to useful and affordable financial products and services — such as banking, credit, insurance, and payment systems — delivered in a responsible and sustainable way.

The goal of financial inclusion is to remove barriers that exclude people from participating in the financial sector and to promote economic growth, reduce poverty, and enhance financial stability.

In the UK, financial inclusion is a collaborative effort involving government departments, regulatory bodies, and independent organisations.

With the Government, HM Treasury leads the UK’s financial inclusion agenda, with the Economic Secretary to the Treasury, currently Emma Reynolds MP, overseeing banking, consumer finance, and access to affordable credit as well as chairing the Financial Inclusion Committee.

Independently, organisations like Money & Pensions Service, Fair4All Finance and the Financial Inclusion Commission work to advocate for financial inclusion.

The Financial Conduct Authority regulates the financial services industry, ensuring fair treatment of consumers. The FCA has initiatives to maintain access to cash and promote basic banking services.

Improving access to appropriate financial services for young people aged 16-25, through education, awareness and product innovation.

Calvin Cowell has previously been a senior leader in financial services, financial coach and banking expert. Calvin works tirelessly on promoting financial inclusion and is undertaking ground-breaking research into financial inclusion within Afro-Caribbean communities.

Calvin is completing a PhD in Economics and Finance at Cranfield School of Management, with a specialisation in Financial Inclusion, and Its Impact on The African-Caribbean Community. As part of his thesis he wrote a draft policy paper on this topic.

Hyfa Foundation is a financial education based in London, founded in April 2023 with charity registration number 1202386.

Its mission is to close the financial knowledge gap by championing financial inclusion and providing educational programmes primarily to 16-25 year olds from deprived areas, online and in-person, that move people from financially vulnerable to financially capable.

All organisations that contribute to improving financial inclusion within the UK are a welcome audience.

Specifically this briefing aims to shape policy, so the briefing is addressed to policy makers within HM Treasury, the Minister for Pensions & Financial Inclusion, and the Department for Levelling Up, Housing & Communities.

Young people (16-25) from deprived areas in England & Wales.

The adoption of the responsibility of financial inclusion by the FCA

The information contained in the Policy Brief is based on the latest relevant data available, curated by Calvin Cowell in an academically rigorous way, and benefits from proprietary qualitative and quantitative information compiled by Calvin during his recent PhD.

Calvin’s pioneering PhD research highlights the African and Caribbean populations in the UK represent a disproportionately high percentage of financially excluded adults. He is the authority on financial inclusion within these communities and so the brief has the potential to address the largest demographic affected by financial inclusion therefore and have the most impact.

Financial inclusion is important because it reduces poverty, promotes economic growth, strengthens financial stability, and empowers individuals by giving them greater control over their lives. Access to affordable and reliable financial services helps people manage money effectively, invest in opportunities, and avoid exploitative systems, benefiting both individuals and society as a whole.

Focusing on financial inclusion among 16–25-year-olds from underrepresented groups is especially crucial because this is a formative period when lifelong financial habits are established. Young people from disadvantaged backgrounds often face greater barriers to financial services, which can entrench inequality and limit future opportunities. By supporting their financial inclusion early, we can prevent long-term disadvantages, promote social mobility, and help unlock their full economic and social potential.

81%